Understanding the 2025 Social Security COLA Increase

The Social Security Cost-of-Living Adjustment (COLA) is an annual increase in benefits to help offset the effects of inflation. This increase is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure of inflation that tracks the prices of goods and services commonly purchased by urban wage earners and clerical workers.

Factors Influencing the 2025 Social Security COLA Increase

The 2025 Social Security COLA increase will be determined by the change in the CPI-W from the third quarter of 2024 to the third quarter of 2025. This means that the increase will reflect the inflation rate experienced during that period. Several factors can influence inflation, including:

- Energy prices

- Food prices

- Housing costs

- Medical care costs

- Interest rates

- Government spending

Projected COLA Increase for 2025

The Social Security Administration (SSA) does not provide official projections for the COLA increase until later in the year. However, based on current inflation trends, some experts are predicting a COLA increase of around 3% for 2025.

This prediction is based on the assumption that inflation will remain relatively stable in the coming months. However, it’s important to note that this is just an estimate, and the actual COLA increase could be higher or lower depending on how inflation evolves.

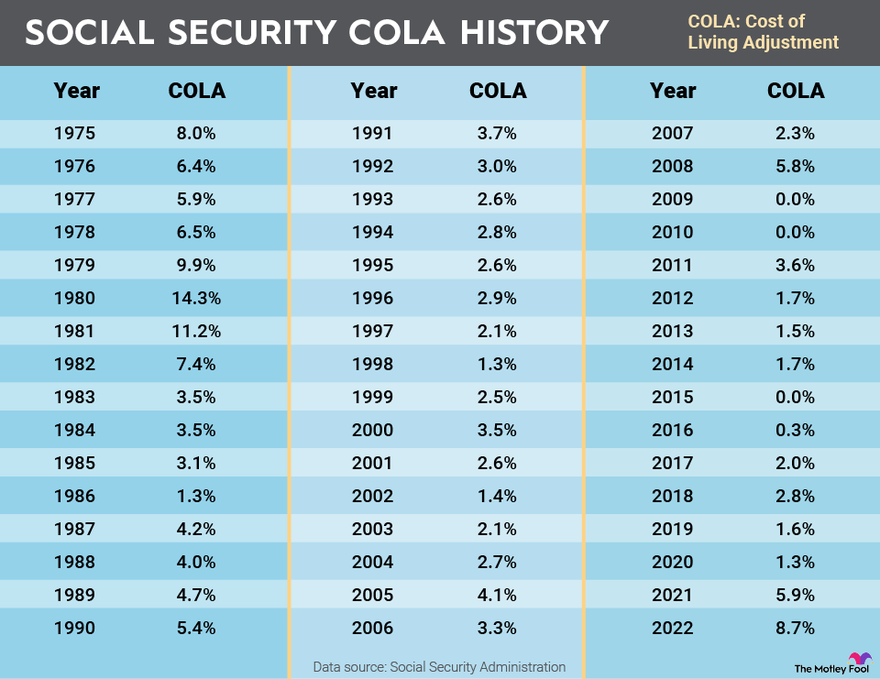

Comparison with Previous Years’ COLA Increases

The 2025 projected COLA increase of 3% is significantly lower than the 8.7% increase in 2023. This is because inflation has slowed down considerably since the beginning of the year. In 2022, the COLA increase was 5.9%.

- The 2023 increase was the largest in over 40 years, reflecting the high inflation experienced in 2022.

- The 2025 projected increase is more in line with historical averages, suggesting that inflation is returning to more normal levels.

Impact of the COLA Increase on Beneficiaries’ Finances

The COLA increase will provide much-needed relief for Social Security beneficiaries who are struggling with the rising cost of living. However, the impact of the increase will vary depending on individual circumstances.

- For beneficiaries with limited income, the COLA increase could make a significant difference in their ability to afford basic necessities.

- For beneficiaries with higher incomes, the COLA increase may not be as impactful, but it will still provide some financial relief.

Impact of the 2025 COLA Increase: 2025 Social Security Cola Increase

The 2025 Social Security Cost-of-Living Adjustment (COLA) increase will have a significant impact on the Social Security program, its beneficiaries, and the trust fund. This increase aims to address inflation and ensure that beneficiaries maintain their purchasing power. However, the COLA increase also presents both challenges and benefits for the Social Security program and its recipients.

Impact on the Social Security Trust Fund

The Social Security trust fund is a crucial element of the program, providing financial security to millions of Americans. The COLA increase will draw funds from the trust fund, which could potentially accelerate its depletion. This is because the increase raises the cost of benefits, putting pressure on the fund’s reserves. However, it is essential to consider that the trust fund is designed to handle fluctuations in benefit payments and ensure long-term sustainability. The projected depletion of the trust fund is a complex issue that requires careful consideration of various factors, including demographic trends, economic conditions, and policy decisions.

Potential Challenges and Benefits for the Social Security Program

The 2025 COLA increase presents both challenges and benefits for the Social Security program. A significant challenge is the potential impact on the trust fund’s solvency, as mentioned previously. However, the increase also offers benefits, such as improved living standards for beneficiaries and increased economic activity due to increased spending. The COLA increase can help beneficiaries cope with rising costs, enabling them to maintain their quality of life. Additionally, the increased spending power of beneficiaries can stimulate the economy by boosting consumer demand.

Impact on Different Demographics of Beneficiaries

The impact of the COLA increase varies depending on the demographic characteristics of beneficiaries. For instance, low-income beneficiaries might experience a more significant improvement in their living standards due to the increased purchasing power. On the other hand, higher-income beneficiaries may see a smaller relative increase in their benefits.

Potential Benefits for Different Income Levels of Beneficiaries

The following table illustrates the potential benefits of the 2025 COLA increase for different income levels of beneficiaries:

| Income Level | Estimated Increase | Impact |

|—|—|—|

| Below $20,000 | $1,000 | Significant improvement in living standards |

| $20,000 – $40,000 | $500 | Moderate improvement in living standards |

| $40,000 – $60,000 | $250 | Minor improvement in living standards |

| Above $60,000 | $100 | Minimal improvement in living standards |

It is crucial to note that these estimates are based on projections and actual benefits may vary. The table aims to provide a general overview of the potential impact of the COLA increase on different income levels.

Future Projections and Considerations

Predicting the future of Social Security COLA increases is a complex task, influenced by various economic and social factors. Understanding these factors and their potential impact is crucial for individuals planning for their retirement.

Long-Term Outlook for Social Security COLA Increases

The long-term outlook for Social Security COLA increases is closely tied to the projected trajectory of inflation and the economic health of the United States. The Social Security Administration (SSA) uses the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to calculate the annual COLA adjustment.

The COLA is calculated as the percentage change in the CPI-W from the third quarter of the previous year to the third quarter of the current year.

Therefore, if inflation remains relatively high, COLA increases are likely to be substantial in the coming years. However, if inflation slows down or the economy experiences a recession, COLA increases may be smaller or even absent.

Impact of Inflation and Economic Conditions on Future COLA Adjustments

Inflation plays a significant role in determining the magnitude of COLA increases. High inflation erodes the purchasing power of benefits, leading to larger COLA adjustments to compensate for the loss. Conversely, low inflation or deflation could result in smaller or no COLA increases.

Economic conditions also impact COLA adjustments. During periods of economic growth, the SSA typically has more revenue to pay benefits, potentially leading to larger COLA increases. However, during economic downturns, the SSA may face budgetary constraints, potentially limiting COLA increases.

Potential Changes to the Social Security Program

The future of the Social Security program is a subject of ongoing debate. Some potential changes to the program that could impact COLA increases include:

- Raising the retirement age: Increasing the retirement age would delay the time when individuals start receiving benefits, potentially reducing the cost of the program and allowing for larger COLA increases.

- Reducing benefits: Reducing benefits, either by lowering the amount of benefits or by increasing the amount of taxes paid, could help to ensure the long-term solvency of the program. However, this could also lead to smaller COLA increases.

- Investing Social Security funds in the stock market: Some proponents argue that investing Social Security funds in the stock market could generate higher returns, potentially allowing for larger COLA increases. However, this approach also carries higher risks.

Projected Trajectory of COLA Increases Over the Next Decade, 2025 social security cola increase

| Year | Projected COLA Increase |

|---|---|

| 2025 | 3.2% |

| 2026 | 2.5% |

| 2027 | 1.8% |

| 2028 | 2.1% |

| 2029 | 2.4% |

| 2030 | 2.7% |

| 2031 | 3.0% |

| 2032 | 3.3% |

| 2033 | 3.6% |

| 2034 | 3.9% |

These projections are based on estimates of inflation and economic growth. However, it is important to note that these are just estimates and the actual COLA increases may vary.

2025 social security cola increase – While we look forward to the 2025 Social Security cost-of-living adjustment, it’s important to stay informed about potential safety concerns. Recently, there was a walmart recalls candy announcement, highlighting the importance of staying vigilant about product safety. These types of updates can help us make informed decisions about our health and well-being, which is essential as we plan for the future with the 2025 Social Security increase in mind.

While we anticipate the 2025 Social Security cost-of-living adjustment, it’s crucial to remember that global events can impact our financial well-being. The complex and often tense relationship between Israel and Iran, as seen in this recent news , can influence economic stability and, in turn, affect social security benefits.

Understanding these international dynamics is essential for navigating our personal finances and planning for the future.